|

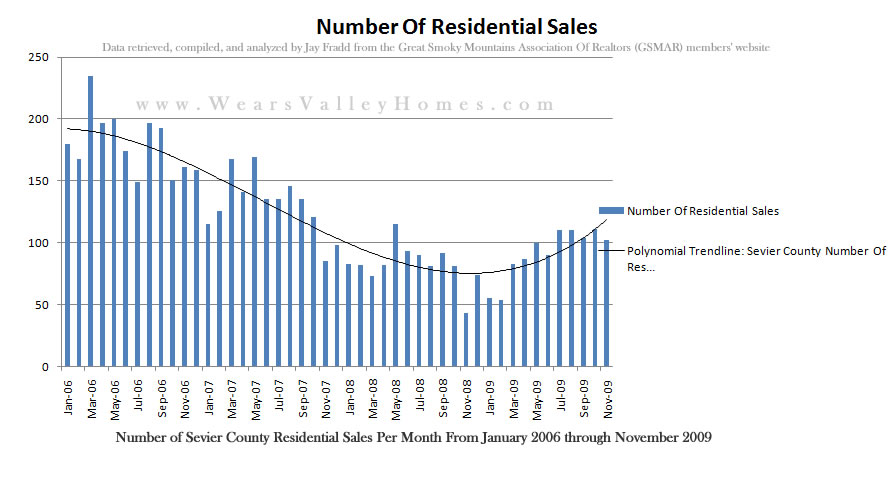

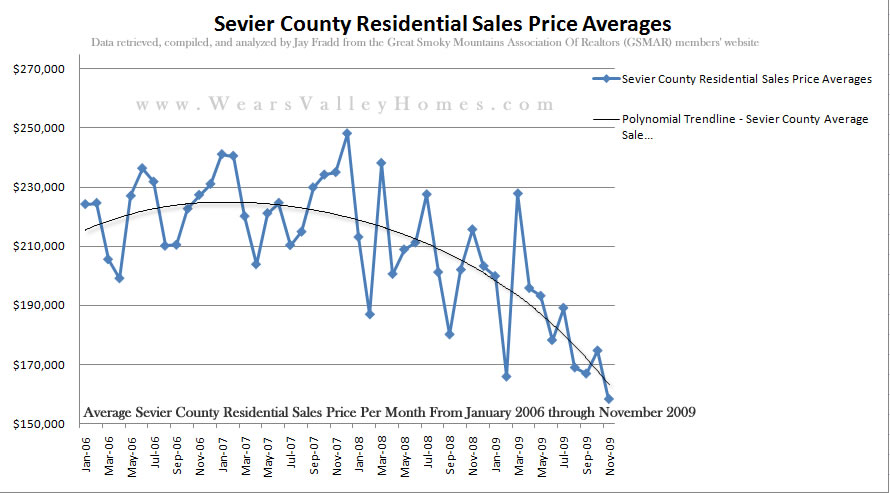

It has been quite a while since I have had a real estate related post on here. I’ve been meaning to write about a variety of different topics, such as development I foresee having a large increase in foreclosures in the near future and what I have been seeing lately in the real estate market. I have also thrown around the idea of creating a “Jay’s cabin of the week” where I list what I find to be the best deal on the market for several different price ranges. I know it can be hard from hundreds or thousands of miles away to truly identify what is a great deal. Sometimes things look good on paper, but when you actually see the property it is quite a different story. That being said, when purchasing real estate it is very important to not only consider what the market may do in the future, but also analyze what has happened in the past. That brings me to the point of this blog post – analyzing the residential sales in Sevier County through November 2009. Please note this includes all residential sales in Sevier County – which is single family residential, condos, mobile homes, and modular homes. The data is limited to Sevier County only rather than the entire Great Smoky Mountains Association of Realtors. This is for a couple reasons, first that is my primary market area and second when you start including other counties such as Blount, Knox, Jefferson, Cocke, and others it begins to distort the data. As people frequently say “real estate is local” and by narrowing down on one particular county I think it gives a better actual perspective of what is happening in the market. After compiling and analyzing the data. There are a couple things that are easily gathered when comparing 2008 to 2009. First with the “positive” indicators.

The number of residential units sold in 2009 has already surpassed 2008 and the 2009 date includes sales only through November. There have been 1,006 Sevier County residential sales through November 2009 while the entire year of 2008 produced 989 sales. Also, as far as Sevier County residential sales volume it has seemed to pick up as well. Although the year to date comparison of 2008 vs. 2009 through November does have 2008 with a slightly higher overall sales volume ($189,468,757 in 2008 vs. $183,501,869 in 2009). The important thing to look at is the recovery in sales volume after the abysmal sales volumes from November 2008 through February 2009. In February 2009, the sales volume was a paltry $8,956,116. This is less than half of the average month in the most recent 6 months of this year which is $18,230,669. So sales volume, although about in line with 2008 has seen a drastic improvement from the beginning of 2009. I will discuss the reasons I feel this is the case later in the blog. Now to the “negative” side of the statistics. Well, I guess depending on which side you are on – low prices are good for buyers and were needed in this market after the inflated cabin prices. The average residential sales price of a home in Sevier County has went down from $206,416 to $182,407. This is a 11.63% decline from 2008. If you compare the average sale price in 2009 to 2007 ($225,438) it is down over 19%. If one analyzed only the cabin market I am certain you would find those numbers to be down even more. The relatively stable permanent resident market has helped keep those figures in check. The numbers, unfortunately, are extremely difficult to analyze differentiating cabin investment sales versus permanent residences for a couple reasons. In our MLS system there are categories for the type of property (log home, log look home, brick, vinyl, etc) along with the property use (residential, overnight rental, or either). The unfortunate thing is many Realtors either fail to add this data or do it incorrectly, so it makes it nearly impossible to gain accurate statistics unless one were to go individual one by one each listing. While I would like to do this, I dont have the time right now. Looking at data and statistics doesn’t mean much unless you can try to explain the rationale behind those figures. I will do my best to explain the reasons behind these statistics. Please understand this is only my opinion and if you asked others they may have a totally different outlook on things. I am trying to use the most common sense, logical perspective combined with a little bit of a finance/economics background. The number of Sevier County residential sales were very low from November 2008 through February 2009. This can easily be attributed to the market being wary due to what had just happened with Bear Sterns, TARP, and the unknown outcome of our financial situation as a country. The stock market VIX (measures the volatility) was through the roof during this time period. People were hesitant to do much of anything until they had more clear sight of what was occurring and the outcome. Many successful investors say that when other people are scared to buy, that is when they are purchasing as fast as they can and vice versa – when other people are buying left and right, that is when they are selling and getting out of the market before the bubble collapses. The increase in residential units sold in my opinion is based on a couple of factors. First, the overall sentiment from people across the nation was put at ease a little as market chaos had gone away for the most part. Also, with the large number of foreclosures available and prices dropping created a peaked interest in our market as a place for a good investment. Previously, with overnight rental cabins priced as they were in 2005 to 2007 most wouldn’t receive a good return on their investment. As the prices have dropped, the returns have improved (despite slightly less rental revenues) and it has become a more appealing consideration from investors. The overall average residential sales price has lowered quite significantly, especially with overnight rental cabins purchased at their peak in 2005 to 2007. The primary driving factor of this is the number of foreclosures. With the large banks wanting to get rid of their inventory the prices have dropped substantially. It isn’t uncommon to see cabins selling for half of what they sold for just a couple years prior. With the relative few sales and buyers in the market from November 2008 to February 2009 this caused banks holding their inventory to drop their prices in order to sell the homes/cabins. This started a downward stair step ( should be two words) scenario where one foreclosure would sell for say $200,000 and another similar cabin in the same development would then sell for $190,000 a month later, and then then next month later for $180,000 and so on. Naturally there is a bottom price point where prices start to recover. I believe that has happened in certain developments where the prices have dropped so low that investors purchase them because they are a “no-brainer” as far as cash flow is concerned and they feel there is some upside appreciation in the long-term future. The scenario of prices recovering has happened in a few developments in my opinion (Black Bear Ridge Resort & Sherwood Forest to name a few) but isn’t indicative of our entire market. There are some developments where the worst is yet to come and will likely face an abundance of foreclosures/short sales. Developments where a large number of foreclosures have cycled through and had time to lower in price seem to be stabilizing and somewhat recovering, while others will likely see a lot more foreclosures and downward price pressure. I will say I have seen a notable difference in the competition for aggressively priced properties. At the beginning of the year, prime foreclosures at great prices were somewhat common and you could put in an offer without it being a multiple bid situation. Recently, I have noticed that the most aggressively price properties receive multiple offers within the first 24 to 48 hours they are on the market. This is due to two factors and they are related to each other. First there are more buyers in our market now and I believe this is because of the substantially lower prices. Simple supply vs. demand tells us when the demand outweighs the supply (in this case of prime foreclosures/short sales at attractive prices) then prices will increase. I have had 21 clients this year make offers on properties that were multiple offer situations where they ended up not being the winning bidder. This has included as few as one other competing offer up to nearly 15 offers on one single property! The vast majority of these ended up selling for more than the listing price. Although this doesn’t necessarily mean there is a recovery and prices are increasing, it is a good indicator. When sales volume and the number of buyers/properties sold is increasing, usually it means prices are to follow. The number of great foreclosures up for sale seem to be dwindling away. This could be because the banks aren’t dumping all of their inventory at once in combination with the foreclosures/short sales not lasting long on the market due to increased competition between buyers. I hope this information is helpful in understanding our real estate market here in Sevier County. If you have any questions or need anything about properties in the Sevierville, Gatlinburg, Pigeon Forge, Wears Valley, or any other area of Sevier County please feel free to contact me.

Jay Fradd (E-mail: jay@WearsValleyHomes.com) |